Why Is Homeowners Insurance So Expensive In Tennessee

When I moved to Georgia and changed my policy address my insurance company told me it was going to cost 300 a month for liability only. How much you spend on home insurance coverage is greatly influenced by the level of coverage you choose.

What To Know About Homeowners Insurance Get The Facts Homeowners Insurance Homeowners Insurance Coverage Best Homeowners Insurance

Here are 16 key factors that influence your homes insurance rates.

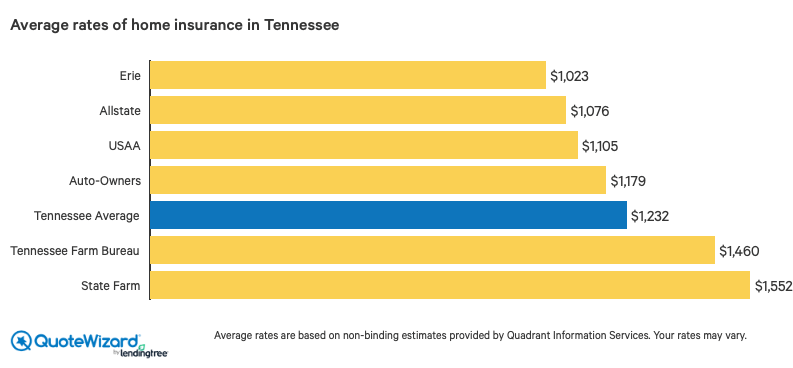

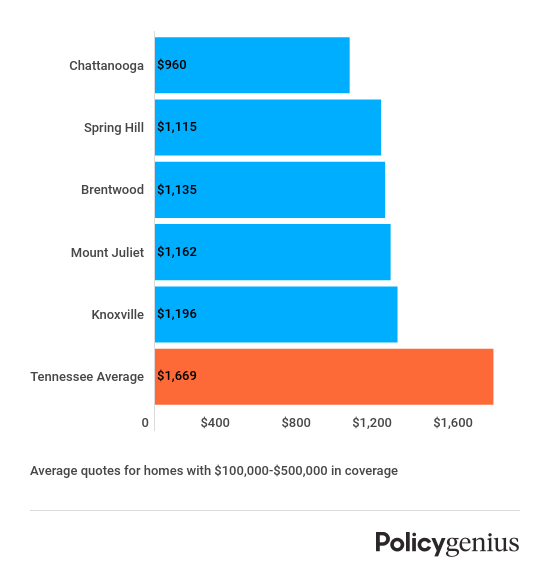

Why is homeowners insurance so expensive in tennessee. We found that Shelter offers the lowest prices to Tennessee homeowners. You may ask the agent why your quote is higher or look in to other providers to see if they are also giving you a higher than average quote. Average homeowners insurance prices in Nashville by coverage limit.

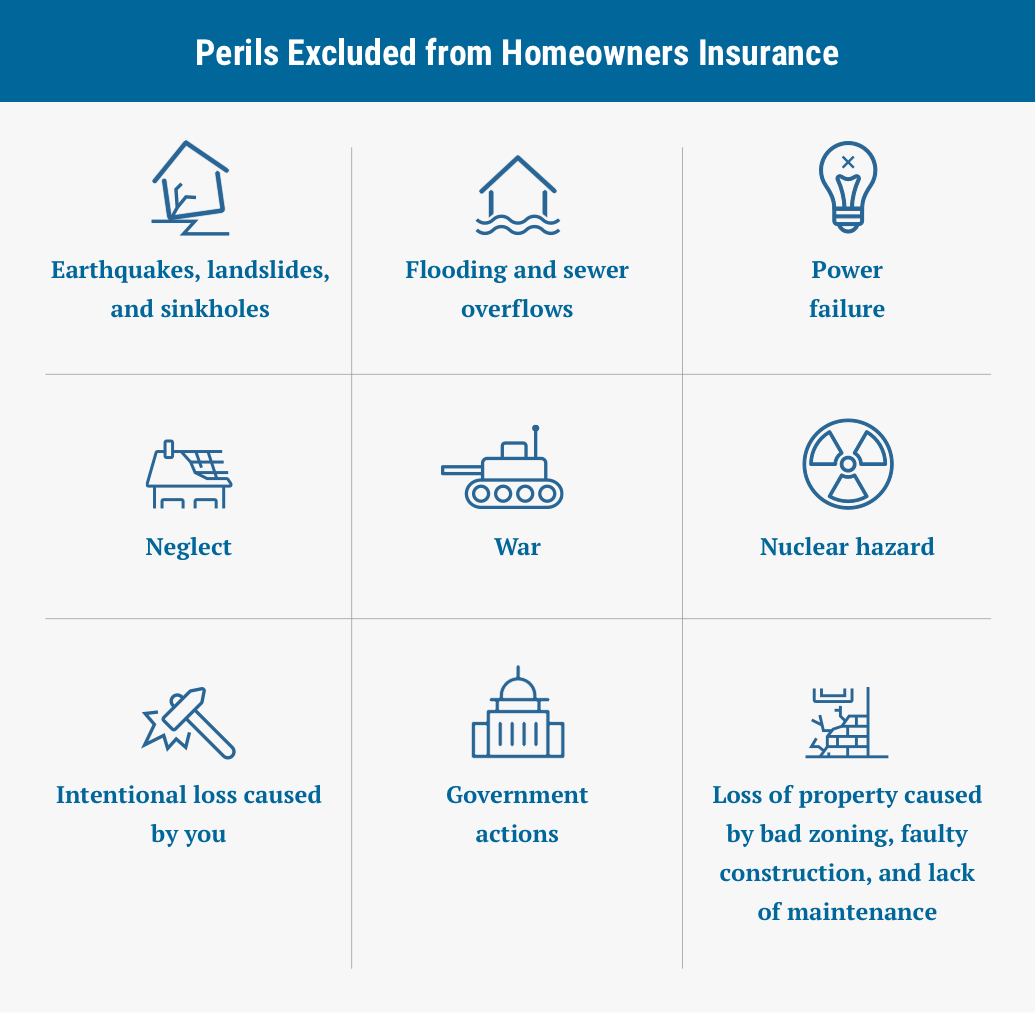

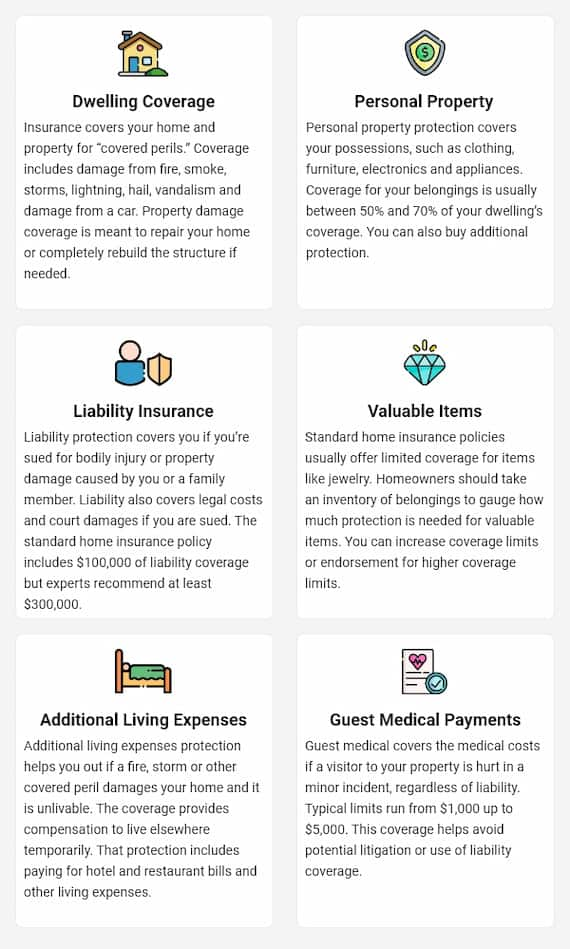

It protects your home and possessions as well as satisfies your lenders insurance requirements. These include wind and hail storms tornadoes floods and wildfires all of which can be destructive to your property. Because Tennessee is prone to tornadoes and even in the.

Thats for a home insurance policy with 300000 in dwelling coverage and 100000 in liability insurance. Homeowners in Nashville who carry 200K in dwelling coverage pay an average of 1198 per year while those with coverage up to 400K pay around 2159 per year. We show average home rates for three other common coverage levels at the end of this article.

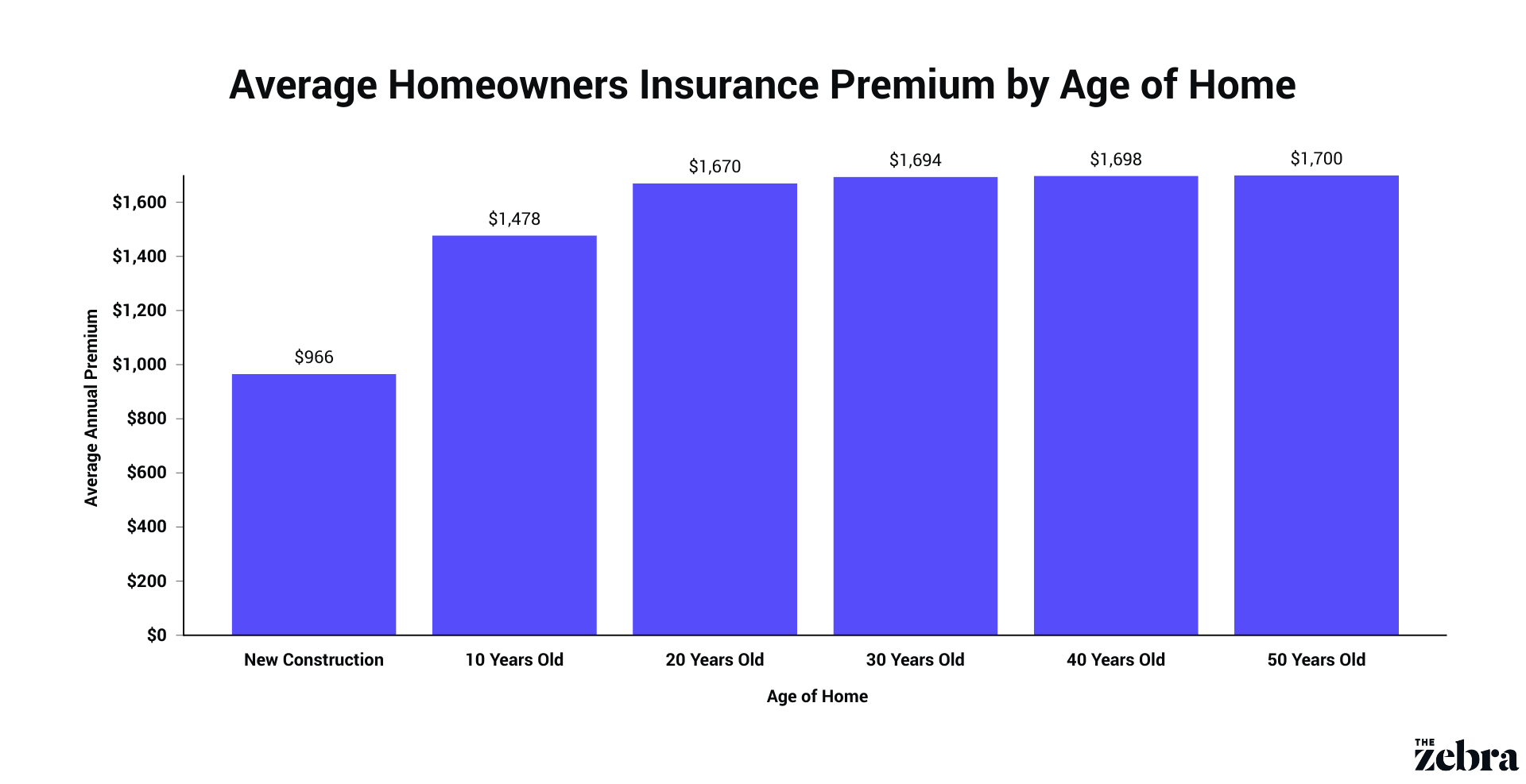

The age of your home its location and even if you have a certain dog breed. Although USAA is slightly more expensive than other homeowners insurance companies customers are often eligible for a variety of discounts that work to lower your costs. In all states except California Maryland and Massachusetts insurance companies can use your credit history when determining home insurance rates.

Homeowners insurance in Tennessee can be more expensive than some states due to it being vulnerable to certain damaging perils. As youll see in the homeowners insurance cost by state chart below Oklahoma is the most expensive state for home insurance 2140 more than the national average for the coverage level analyzed. The Cost of HOA Fees Can Change HOA fees can increase or decrease over time.

Youll also receive 10 percent off if you remain claim-free for at least five years on your homeowners condo or renters insurance. If you bump up liability to 300000 the national average cost is 2305. The cost of seasonal maintenance can also influence the cost of your dues.

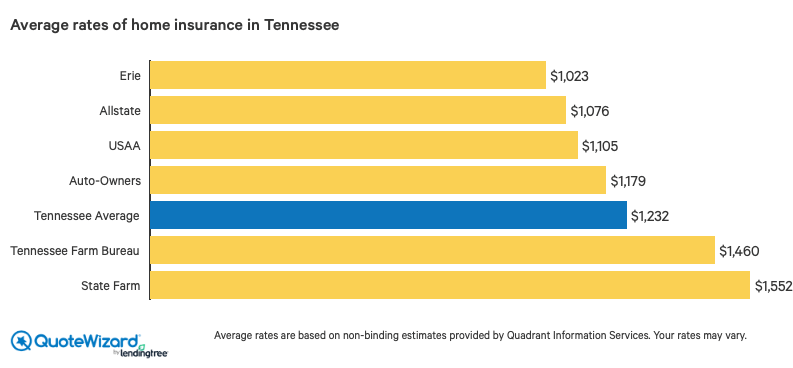

Tennessees average homeowners insurance premium costs have been affected by a series of natural disasters. While the cost will typically stay within a certain range unexpected charges such as an emergency repair can raise the cost of dues. The cheapest options for homeowners insurance in Tennessee.

We collected hundreds of quotes from homeowners insurance companies across Tennessee in order to find the best price. Homeowners insurance is a necessity. Besides earthquakes Tennessee is vulnerable to flooding and tornadoes.

Tere are many factors that play into your insurance rate. I paid 100 a month in Florida. Homeowners insurance is a crucial form of financial protection for Tennessee homeowners.

With homeowners insurance your home is covered in the event its burglarized or damaged by bad weather or any of the common natural disasters in the Volunteer State like hail storms tornadoes and wildfires. In 2010 Nashville suffered a devastating flood that took a huge economical toll killed 11 people and displaced thousands of people from their homes. Why is car insurance so expensive in Georgia compared to Florida.

If you fail to maintain insurance or even fall below the required coverage levels your lender just may step in and put a policy in place a very expensive policy. So make sure you take advantage and shop around for the best home insurance deals in Tennessee. Tennessee Homeowners Insurance Rates by Credit Score Legend.

If so its time to look at your conditions to see why this is so. Median Credit Homeowner Excellent Credit Homeowner Chattanooga Clarksville Knoxville Memphis Nashville 150 300 450 600 750 900 1050 1200 1350 1500 1650 1800 1950 2100 2250 1641 1165 1641 1165 1509. Why is my homeowners insurance so high and is there anything I can do it lower it.

Youll need coverage but when you break down your housing costs the price of your premium makes you wonder. State Farm the largest home insurance provider in Tennessee holds 24 percent share in Tennessee homeowners insurance market. Homeowners insurance protects you in the event of fire theft or otherwise unlikely yet high-risk scenarios you dont want to gamble on.

The Best And Cheapest Homeowners Insurance Companies In Tennessee Valuepenguin

6 Best Homeowners Insurance Companies Of August 2021 Money

What Makes You Ineligible For Homeowners Insurance

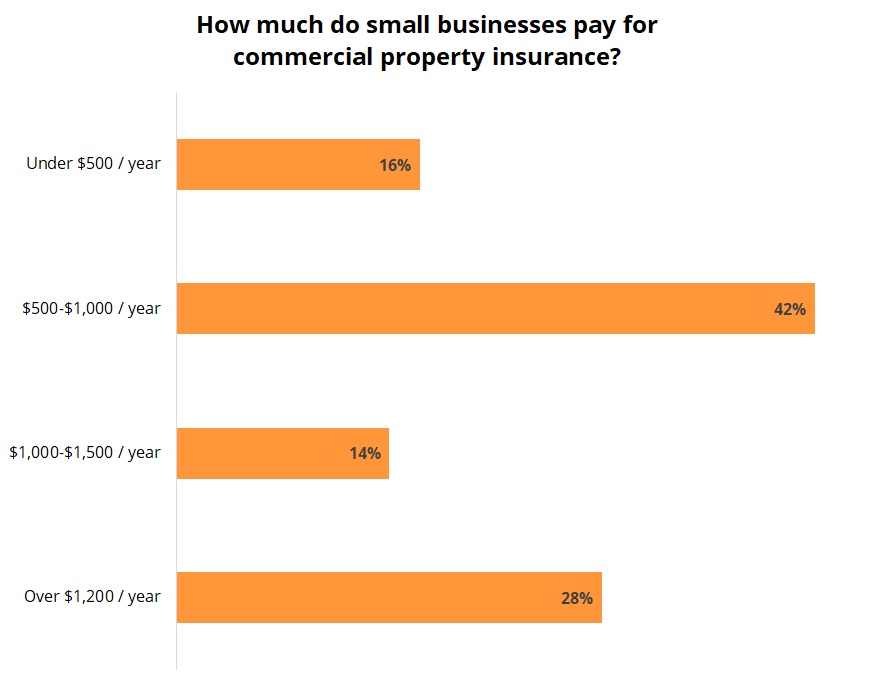

Commercial Property Insurance Cost Insureon

How To Buy Homeowners Insurance Insurance Com

Buy Home Insurance House Insurance Policy Which Will Protect Not Only Your Home But Also The Belon Home Insurance Quotes Home Insurance Buy Health Insurance

Best Cheap Homeowners Insurance Companies Nextadvisor With Time

6 Best Homeowners Insurance Companies Of August 2021 Money

10 Ways You Can Get Cheap Homeowners Insurance Forbes Advisor

Guide To Homeowners Insurance On Inherited Property Homego

Best Home Insurance Rates In Tennessee Quotewizard

Home Insurance For Older Homes The Zebra

What Makes You Ineligible For Homeowners Insurance

Homeowners Insurance In Tennessee Policygenius

Average Cost Of Condo Insurance 2021 Valuepenguin

The Ultimate Guide To Home Insurance Home Insurance Homeowners Insurance Insurance Marketing

Homeowners Insurance Cover Compare Home Insurance Options And Deals Homeowners Insurance Coverage Home Insurance Quotes Home Insurance

Post a Comment for "Why Is Homeowners Insurance So Expensive In Tennessee"