Property Insurance Rates In Arkansas

Jefferson County has the highest average home insurance rate in Arkansas of 1477 a year. This is more than the national average of 1173 according to the Insurance Information Institute.

Insurance Companies Don T Want You To Know This Finance Daily Getting Car Insurance New Tricks Saving Money

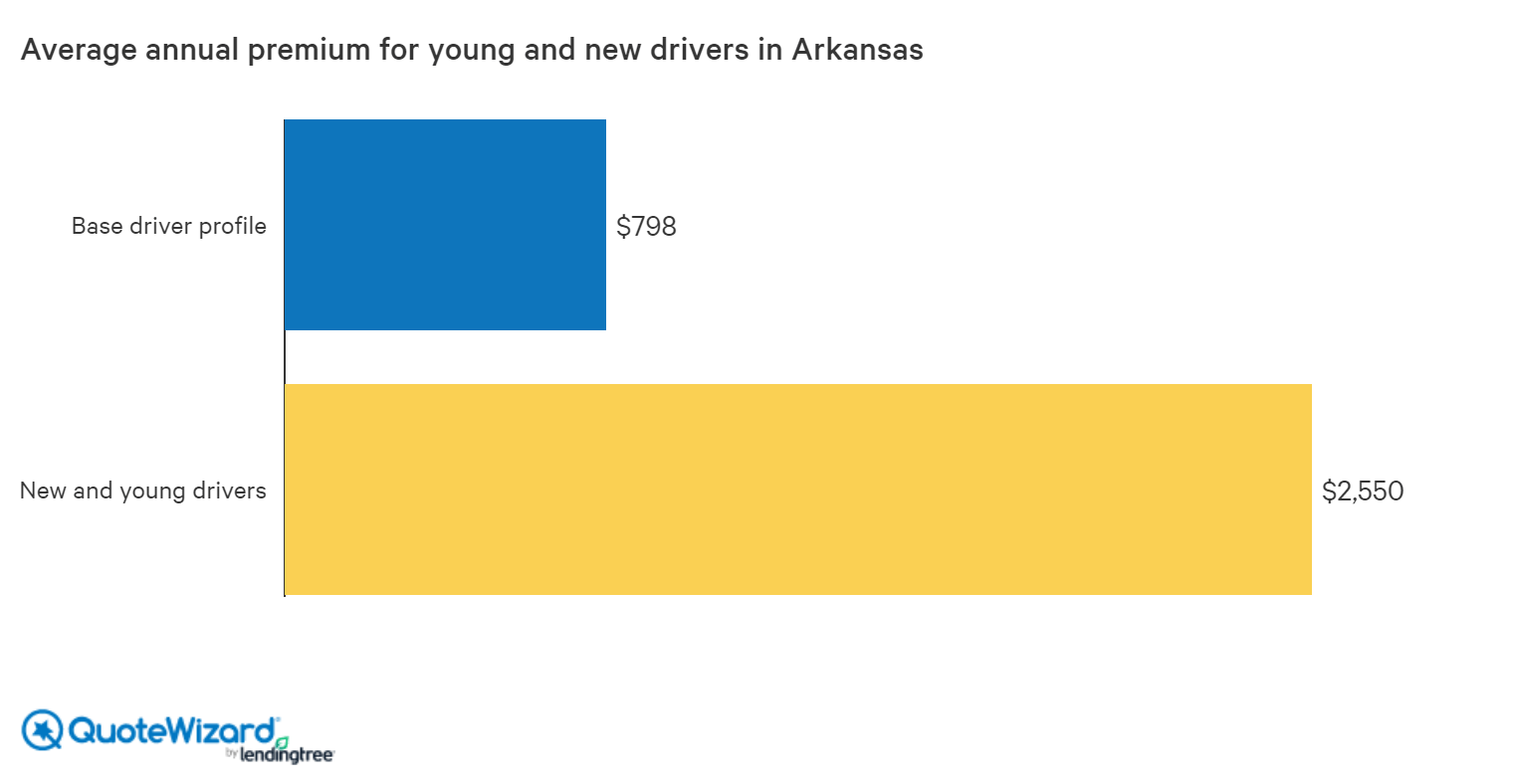

Auto insurance is expensive in Arkansas.

Property insurance rates in arkansas. Though a variety of factors will affect your premium such as home size age discounts and location the average cost for insurance in Arkansas is 1312. The average home insurance cost is 2305 nationwide but it can vary by state. Make the most of your income property by getting the best landlord policy at.

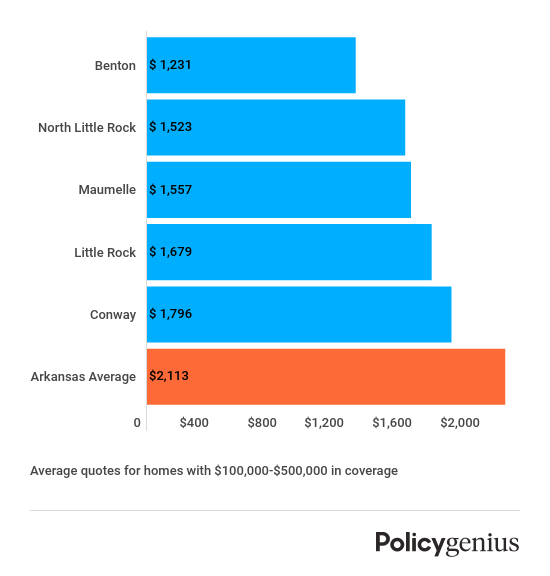

The table below shows how the largest cities in Arkansas average home insurance rates compare. Thats for a home insurance policy with 300000 in dwelling coverage and 100000 in liability insurance. If you bump up liability to 300000 the national average cost is 2305.

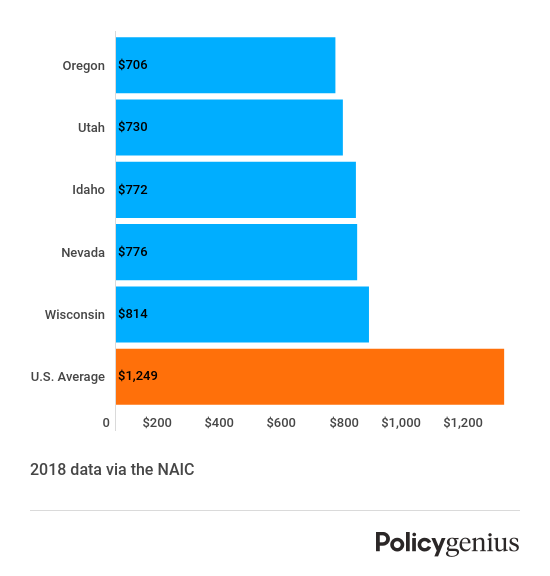

Most of the larger cities in Arkansas stay under the state average of 1292 excluding Pine Bluff at 1381 and Fort Smith at 1391. The average auto insurance price in Arkansas is 1458 per year more than the US average by 21. Two of the most common levels of renters insurance coverage are 25000 and 50000.

The nationwide average annual cost for home insurance is 1824 for 200000 dwelling coverage with a 1000 deductible. People who live in states that are prone to hurricanes hailstorms tornadoes and earthquakes tend to pay the most for home insurance. Electronic Funds Transfers EFT are required and due at the time of submission of the filing through SERFF.

Arkansas is not a retaliatory fee state for property casualty lines of insurance. What is 100 coinsurance in property insurance. We provide reliable affordable renters coverage for renters across the state of Arkansas.

Whether youve put down roots in cities like Little Rock or Fort Smith or in quaint towns like Bentonville you and your family can depend on a home insurance policy from Nationwide. Get a fast quote and your certificate of insurance now. How Is Vacant Property Different From Commercial Property Insurance.

Valuables Plus 1 insurance may cover items such as jewelry watches antiques. Auto insurance premiums price based on myriad factors including your marital status driving history credit rating gender and age. View in Public Access.

Below by using our home insurance calculator you can find average home insurance rates by ZIP code for 10 different coverage levels. Todays mortgage rates in Arkansas are 2804 for a 30-year fixed 2244 for a 15-year fixed and 3067 for a 51 adjustable-rate. One hundred percent coinsurance requires you to insure 100 of the value of your property.

Your car insurance prices are affected by more than just geography. Average Arkansas car insurance rates are 90634yr or 75mo. Policy features that may meet the needs of Arkansas renters.

From Jonesboro to Fayetteville to the Louisiana border and all the towns in between Nationwide has you covered. Nationwide Mutual Fire Ins Company. However there is a higher risk of the policyholder being penalized if property is not valued accurately.

Since there are no operations there vacant commercial properties tend to pose more risks than occupied ones. In Arkansas the annual cost differential between these options is approximately 72. Arkansas car insurance minimum liability requirements are 255025 for bodily injury and property coverage.

Renters insurance in AR by coverage tier Your renters insurance rates will vary depending on the amount of coverage you purchase. In Arkansas owning a rental property can be a tough business but we try to help by offering easy access to landlord insurance online. Effective April 27 2015 Arkansas will allow the re-opening of closed filings or post-submission updates on closed filings for minor corrections.

Arkansas vacant property insurance protects your unoccupied buildings from lawsuits with rates as low as 37mo. Get investment property information and landlord home insurance quotes in AR from top carriers. Location is one of the biggest factors in your home insurance rates.

Premium rates are generally lower for policies that require 100 coinsurance. Enter in your ZIP code then select a dwelling coverage amount deductible and liability amounts. If you own a home in Arkansas its crucial to protect your investment with the right homeowners insurance policy.

Arkansas is currently the 13th most expensive state for homeowners insurance.

Best Car Insurance Rates In Arkansas Quotewizard

Most Least Expensive States In The Country For Home Insurance Home Insurance Homeowners Insurance Life Insurance Policy

Best Homeowners Insurance In Arkansas 2021 Bankrate

The Best And Cheapest Home Insurance Companies In Arkansas Valuepenguin

Check Out This Graph On The Most Expensive States To Insurance A Car State Champs Car Insurance Insurance

Arkansas Home Insurance From 1 795 Year The Zebra

Who Has The Cheapest Renters Insurance Quotes In Arkansas Valuepenguin

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

Insurance Question Life Insurance Quotes Travel Insurance Quotes Home Insurance Quotes

Homeowners Insurance In Arkansas Policygenius

Why Did No One Tell Drivers With No Tickets In 3 Years About This New Rule Car Insurance Buy Life Insurance Online Life Insurance Policy

Pin On Behind The Scenes Junior League Of Northwest Arkansas

Erie Homeowners Insurance Besthomeownerinsurance Home Insurance Car Insurance

Arkansas Title Insurance Calculator With 2021 Rates

When Will I Loose My Health Insurance Life Insurance Quotes Term Life Insurance Quotes Home Insurance Quotes

Best Cheap Car Insurance In Arkansas For 2020 Best Car Insurance Best Car Insurance Rates Cheap Car Insurance

Post a Comment for "Property Insurance Rates In Arkansas"